Contact Us

Why You Should Consider Buying Crypto Mining Equipment For Sale?

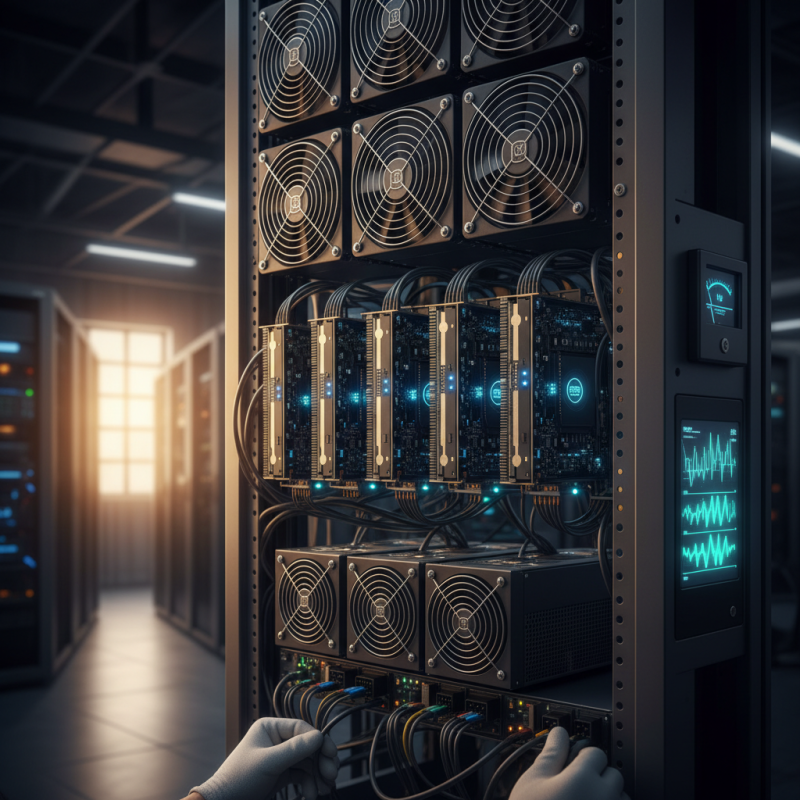

In recent years, the cryptocurrency market has surged in popularity and profitability. According to a report by Statista, the global crypto market capitalization reached over $2 trillion in 2021. This growth has sparked interest in crypto mining, leading many to consider purchasing "Crypto Mining Equipment For Sale." The demand for mining hardware is at an all-time high. Miners can generate substantial returns by investing in this specialized equipment.

However, it's crucial to reflect on the complexities involved. Mining cryptocurrencies requires significant energy and technical knowledge. The rise of renewable energy in mining practices is a promising trend, yet many miners still face high electricity costs. Potential buyers should weigh the benefits against these factors.

Additionally, the rapid technological advancements in mining hardware can lead to quick obsolescence. Many purchase equipment only to realize it may not yield competitive returns. Research shows that understanding the market and selecting the right equipment is essential for success. Considering "Crypto Mining Equipment For Sale" is a prudent step, but buyers must approach it with caution and informed analysis.

Benefits of Investing in Crypto Mining Equipment

Investing in crypto mining equipment can be a significant decision. Many people overlook this opportunity, focusing instead on buying cryptocurrency directly. However, owning mining equipment allows you to earn coins by validating transactions. This can lead to potential profits over time.

The benefits of owning mining hardware are considerable. First, you gain control over your mining operations. You can choose when and how much to mine. Additionally, mining equipment can become more valuable as demand rises. This presents a dual opportunity for profit. However, the initial investment can be steep. It’s essential to consider electricity costs and maintenance. These factors may impact your overall returns.

Mining isn't without challenges. The market can be volatile. Prices for cryptocurrency fluctuate frequently. There is also the risk of equipment becoming outdated. This could lead to potential losses. Prospective miners must weigh these risks against the rewards carefully. In the midst of uncertainty, owning mining equipment can still offer unique advantages.

Understanding How Crypto Mining Works

Crypto mining involves solving complex mathematical problems to validate transactions on a blockchain. Miners use powerful equipment to perform these calculations. This process is crucial for maintaining the network's security and integrity. By participating in mining, individuals can earn cryptocurrency rewards.

Understanding how mining works can help you make informed decisions. Equipment efficiency matter greatly. Some setups might seem appealing but require high energy costs. The initial investment can be daunting. There are also fluctuations in cryptocurrency values to consider.

Many enthusiasts overlook maintenance needs. Cooling systems are essential to avoid overheating. It’s unexpected how quickly equipment can degrade without proper care. Therefore, do thorough research before committing. Look for options that balance performance and longevity. These insights can lead to better choices in a volatile market.

Factors to Consider Before Buying Mining Equipment

When considering crypto mining equipment, you need to evaluate several key factors. The type of cryptocurrency you aim to mine is crucial. Each coin has its own requirements. Some may need specialized hardware while others can be mined with general-purpose devices. Ensure the equipment meets these specifications to maximize your investment return.

Energy consumption is another important aspect. Mining consumes a lot of electricity. Higher energy costs can eat into your profits. Research local electricity rates and the power efficiency of the equipment. You may find that gear with a higher initial price can lead to lower long-term costs.

Budget constraints also play a big role. It’s easy to overspend on high-end models. Assess your financial situation realistically. You might end up with equipment that exceeds your needs. This could lead to regrets later on. Always keep in mind the ongoing operational costs, not just the initial purchase price. The more informed your decisions, the better your chances of success in the dynamic crypto mining landscape.

Why You Should Consider Buying Crypto Mining Equipment For Sale? - Factors to Consider Before Buying Mining Equipment

| Mining Equipment Type | Hash Rate (MH/s) | Power Consumption (W) | Price ($) | Return on Investment (ROI) (Months) |

|---|---|---|---|---|

| GPU Miner | 200 | 600 | 1,200 | 6 |

| ASIC Miner | 1000 | 3000 | 2,500 | 8 |

| FPGA Miner | 800 | 2500 | 1,800 | 7 |

| Combined Mining Rig | 1500 | 4000 | 3,000 | 10 |

Types of Crypto Mining Equipment Available

When considering investing in crypto mining, understanding the types of equipment available is essential. There are primarily three categories: ASIC miners, GPU miners, and FPGA miners.

ASIC miners are designed specifically for cryptocurrency mining, offering high efficiency and processing power. They dominate the market, accounting for about 75% of mining activities in 2023, according to industry reports.

GPU miners, while less efficient than ASICs, are versatile and can be used for gaming and other tasks. They represent around 20% of the market. This versatility can appeal to beginners. FPGA miners, though less common, offer customizable solutions for advanced users.

Industry data indicates that FPGA mining can yield higher returns, but it requires technical skills and investment in development.

Purchasing mining equipment comes with challenges. Prices fluctuate, often influenced by market volatility. Returns on investment can be unpredictable. Many new miners face steep learning curves. Understanding power consumption and hardware maintenance is crucial.

These factors can significantly impact profitability. It's important to research thoroughly before making decisions.

Long-Term ROI and Profitability of Mining Equipment

Investing in crypto mining equipment can be a strategic choice. Many view mining as a complex venture. However, the potential long-term ROI is worth considering. Mining equipment has evolved, becoming more efficient and powerful. This shift may enhance your chances of profitability.

Operating costs are an important factor. Electricity consumption, heat management, and maintenance should be carefully evaluated. These aspects can impact overall gains significantly. It’s essential to perform thorough calculations. Unexpected expenses can arise, leading to profit margins diminishing faster than expected.

Market volatility also plays a role. The value of cryptocurrencies fluctuates widely. Prices can soar or plummet in a short time. Therefore, your profitability from mining is not guaranteed. Remaining aware of market trends can help in decision-making. In this landscape, continuous learning and adapting must be part of your strategy.

Related Posts

-

How to Choose the Best Cryptocurrency Miners For Sale in 2025

-

Best Bitcoin Miner Store Reviews and Buying Guide?

-

Best Crypto Mining Rigs For Sale 2026 Which One to Choose?

-

What is a Bitmain Container and How Does It Work for Mining?

-

How to Optimize Your Mobile Mining Unit for Maximum Efficiency in 2025

-

Unlocking Cash Flow: How Btc Asic Miners Are Changing the Future of Cryptocurrency Profits